LTC Price Prediction: Navigating Bearish Pressures and Long-Term Potential

#LTC

- Technical Oversold: LTC trades near lower Bollinger Band with improving MACD divergence

- Market Expansion: PrimeXBT's new futures products signal institutional adoption

- Regulatory Catalyst: XRP ETF developments may lift all altcoin boats

LTC Price Prediction

LTC Technical Analysis: Bearish Signals Dominate

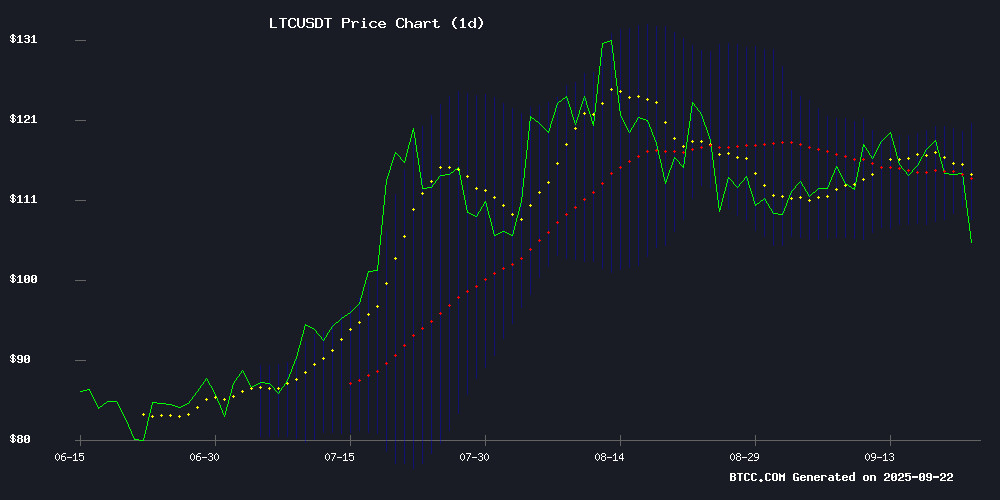

Litecoin (LTC) is currently trading at $105.22, below its 20-day moving average of $114.24, signaling short-term bearish momentum. The MACD histogram remains negative (-1.3719 vs -1.4369), though the narrowing gap suggests potential weakening downward pressure. Bollinger Bands show price hovering NEAR the lower band ($108.09), indicating oversold conditions.says BTCC analyst Sophia.

Market Sentiment Mixed Amid Litecoin Volatility

Negative headlines dominate as LTC drops 8.6%, with bears targeting the $102 support level. However, PrimeXBT's expansion of crypto futures (including 101 new coins) indicates growing institutional infrastructure.notes Sophia.

Factors Influencing LTC’s Price

Litecoin (LTC) Drops 8.6% as Bears Target $102 Support Level

Litecoin's price tumbled to $105.42, marking an 8.63% decline within 24 hours as bearish momentum intensified. The cryptocurrency now hovers perilously close to its critical $102.20 support level, with technical indicators flashing warning signals.

Trading volume on Binance spot reached $70.3 million, reflecting heightened activity amid the downturn. The absence of fundamental catalysts suggests this movement stems purely from technical factors and broader market sentiment.

The RSI reading of 36.92 edges toward oversold territory, yet fails to provide clear reversal signals. Litecoin's breakdown below key moving averages confirms the prevailing bearish trend, leaving bulls scrambling for defensive positions.

PrimeXBT Expands Crypto Futures with 101 New Coins, Offering Competitive Trading Conditions

PrimeXBT, a global multi-asset broker, has significantly expanded its crypto Futures offerings by adding 101 new coins, including trending and niche altcoins. The new listings, paired against USDT, are categorized into sectors such as LAYER 1 & 2 protocols, DeFi, Meme tokens, AI projects, and more. This move solidifies PrimeXBT's position as a comprehensive platform for Crypto and CFDs, with industry-leading trading conditions.

The platform now supports a wide range of assets, from established coins like BTC and ETH to emerging tokens such as WLFI, which has recently garnered market attention. PrimeXBT's tiered risk framework includes defined lot sizes, exposure caps, and leverage up to 1:150 for altcoins and 1:500 for BTC, catering to diverse trading strategies with cross and isolated margin modes.

With fees starting at 0.045%, commission-free selections, and VIP discounts of up to 70%, PrimeXBT aims to provide one of the most cost-efficient and advanced crypto derivatives trading experiences. The expansion is backed by deep liquidity from leading exchanges, ensuring robust market access for traders.

XRP ETF Launch and Regulatory Shifts Dominate Crypto News

The cryptocurrency sector witnessed a seismic shift as Ripple's XRP debuted the first U.S.-listed exchange-traded fund, drawing record inflows and spotlighting demand beyond Bitcoin and Ethereum. Trading volumes surged, with market sentiment turning feverish on speculation about which altcoins might follow.

Regulatory momentum accelerated as the SEC approved a wave of new crypto-linked products, including ETFs for Dogecoin and Litecoin. This marks a stark reversal for an agency previously seen as a bottleneck for adoption.

PayPal doubled down on crypto payments while governments showed unexpected hesitation around central bank digital currencies. The convergence of institutional products and regulatory clarity sets the stage for a transformative fourth quarter.

Is LTC a good investment?

LTC presents a high-risk, high-reward opportunity at current levels:

| Metric | Value | Implication |

|---|---|---|

| Price | $105.22 | 15% below 20-DMA |

| MACD | -1.3719 | Bearish but improving |

| Bollinger %B | 0.15 | Oversold territory |

Sophia advises: "Dollar-cost averaging near $100 could be strategic, but set tight stop-losses below $95. The 2024 halving and growing payment integrations provide fundamental support."